If you are spending time and effort to move items with you to your new location, those items must be important. And if they are important, you should protect them with moving insurance. Most movers offer some form of moving insurance, and understanding and using this product wisely can give you peace of mind during one of the biggest transitions of your life.

What is moving insurance?

Moving insurance is not insurance in the same way that health insurance or auto insurance are. Instead, moving insurance, also referred to as valuation, refers to the amount of liability a moving company agrees to take on in the event that your items are damaged or destroyed during your move. This liability typically takes the form of a specific amount of monetary compensation for the damaged items.

Are movers required to offer moving insurance?

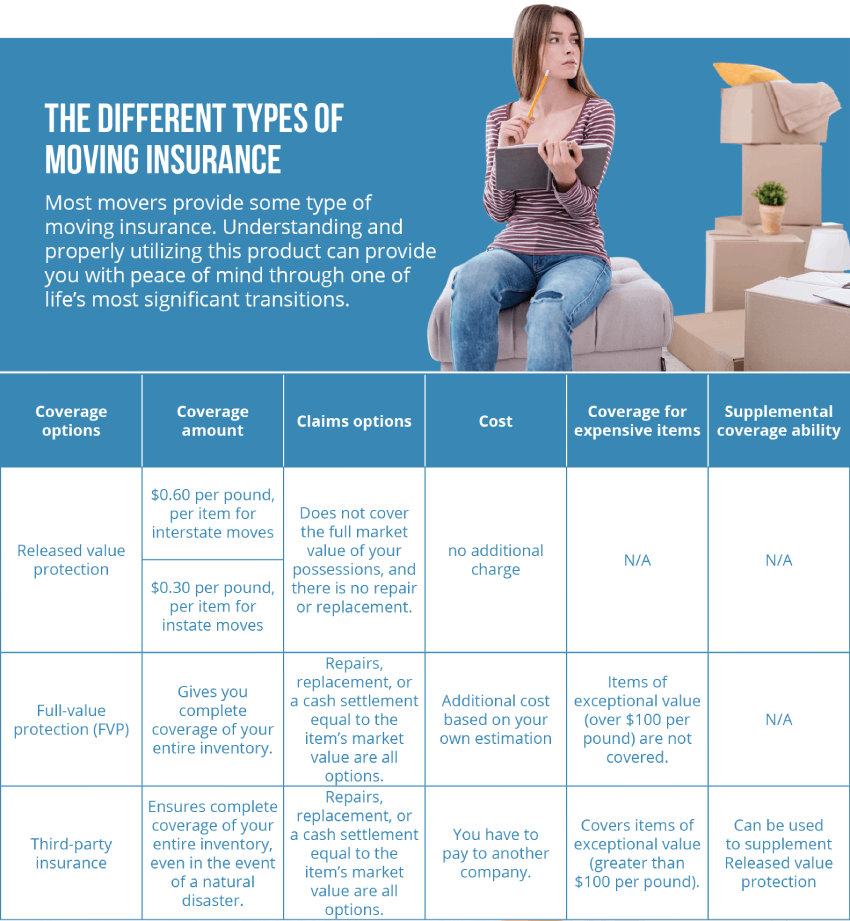

Most movers are required by law to offer at least a basic form of moving insurance. Here is a look at the two most common forms of valuation your mover is likely to provide:

Released Value Protection

Released value protection, or basic coverage protection, comes at no cost to you. However, you will need to include a request for it in your moving contract.

Basic coverage typically provides you with a small amount of compensation per pound per item. This coverage is usually 30 cents for in-state moves and 60 cents per pound for interstate moves.

For example, if your mover damages your 200-pound dining room table during an interstate move, you would receive $120 (200x.6=120) in compensation, regardless of how much you paid for that table.

Full Value Protection

If you want to protect your items for as much as they are worth, you can choose full value protection for your moving insurance. You will need to pay a premium for this insurance, and sometimes also a deductible.

Full-value protection gives the mover three options for compensating you for any damaged or destroyed belongings.

- 1. Replacement of the item

- 2. Repair of the item

- 3. Monetary compensation for the full market value of the item

When purchasing this type of moving insurance, you declare the value per pound of your belongings, and pay a premium based upon that declaration. You may need to meet a certain minimum value per pound in order to obtain full-value protection for your items, and some high-value items may not be included, so you will need to check with your mover about any limits or terms for their full-value protection option.

What is a deductible in moving insurance?

A moving insurance deductible is the amount of money you need to pay before the insurance company will compensate you for your damaged items.

For example, say your dining room table is valued at $1,000 and you have a $250 deductible. The moving company would give you $750 toward the replacement of the table, or pay anything over $250 to repair it.

Before choosing moving insurance with your mover, consider the terms of the insurance in order to choose the deductible and the terms that best fit your needs.

What is not covered in moving insurance?

Not everything is covered under moving insurance. There are certain instances where your items may not qualify for compensation if damaged, including the following:

- Items you packed yourself.

- Delays in reporting lost or damaged items.

- High-value items worth more than $100 a pound

- Packing dangerous items (e.g. chemicals) without telling your mover

In order to get the full value out of your moving insurance, make sure you take the following steps:

- Discuss the terms of your insurance upfront with the mover

- Determine the amount of time you have to make a claim

- Make any claims promptly

- Request coverage of high-value items in writing

- Notify your mover of any dangerous items that you are planning to move

- Follow your mover’s guidelines regarding which items/substances they will move and which they will not.

How much does moving insurance cost?

The cost for moving insurance depends upon a number of factors, including the following:

- Your mover

- The type of insurance you choose

- The value of your belongings

- Your deductible

- Any high-value items you own

Discuss your moving insurance needs with your mover, and get the terms in writing so you can know for sure how much you will pay to protect your belongings.

Are there protection options besides moving insurance?

If you want to protect your belongings without purchasing moving insurance from your mover, you can look into other options, such as third-party insurance or using your homeowner’s or rental insurance.

Third-Party Moving Insurance

You can purchase moving insurance from third-party companies. For example, you can take the released-value protection from your mover, and purchase additional protection from a third-party provider. Consider all of your options before making this choice, including a comparison of how the third party’s quote compares to your mover’s valuation costs.

Homeowner’s or Rental Insurance

Sometimes, people assume that their homeowner’s insurance will cover their belongings during a move, but this is not always the case. Even if you are completing your move yourself, rather than using a mover, you cannot assume that coverage from your current insurance will apply to your move. Instead, check with your insurance provider to see exactly how much coverage they will provide for your belongings during your move.

Do you need moving insurance?

If you are wondering “Should I get insurance for my move?” you should remember that accidents can happen, even to the most professional and experienced movers. Adopting at least released-value protection can help you to get compensation in case of accidental damage. Since released-value protection does not cost you anything additional, it is also a no-risk decision for your move.

Additional moving insurance may be worth it depending upon the circumstances of your move. In particular, consider the value of your belongings. If you are moving many essential or valuable items, full-value protection can be the best choice for giving you peace of mind during the move, and compensation in a worst-case scenario.

In general, when deciding whether to get moving insurance, and how much to get, consider factors such as the following:

- The distance of your move

- The conditions of your move

- The value of your items

How do you determine the value of your belongings?

When choosing moving insurance, you should know the value of your belongings. To determine this value, take the following steps:

- 1. Estimate the combined weight of your items.

- 2. Write down the market value of your highest-value items.

- 3. Note any items that have a value of more than $100 per pound.

- 4. Choose moving insurance that provides coverage of the total weight and/or value of your belongings, including your high-value items.

Moving insurance can give you peace of mind during your move. So can finding a professional mover with years of experience in safe and secure transportation of belongings. Choose Ward North American to provide the reliable, professional-strength moving services, and insurance, you need for a stress-free move.